I have pitched Superior Industries (NYSE:SUP) before and unfortunately I was too early (same as being wrong). Since the analysis in that piece was quite superficial I won’t link it here, but I will expand on it and explain why I think 2025 is the year the stock finally works.

Summary

SUP is an auto parts supplier manufacturing aluminium wheels for OEM’s. As such they are a cyclical company exposed to and dependent on production volume’s from OEM’s. These volume’s peaked in 2017 and have yet to recover to even 2019 pre-pandemic levels. For reasons I’ll get into I believe production volumes will increase again in the coming years.

Besides lower volumes SUP has also suffered from a poor acquisition in 2017. Financing for this acquisition has complicated the capital structure and levered the balance sheet. SUP has taken steps to address both with a European restructuring and a recent refinancing.

Even at current volumes SUP generates enough cash to rapidly pay down debt. Despite this shares are trading near multi year lows and in my view present an attractive investment opportunity.

Company history

SUP was founded in 1957 by Louis L. Borrick and went public on the NYSE in 1969. Initially the company made aftermarket steel and cast aluminum wheels. In 1975 the company started producing aluminum wheels for the Ford Mustang II. Over the years they have become one of the world’s largest manufacturers of wheels, with Ford, GM, Toyota and the VW Group as their largest customers.

Recent history started in 2017 with the acquisition of UNIWHEELS AG for $714.7 million. This acquisition expanded SUP’s geographical footprint into Europe. It also introduced leverage to a previously debt-free balance sheet. To finance the purchase SUP issued $150 million Convertible Redeemable Preferred Stock. The prefs are exclusively owned by TPG Growth III Sidewall, L.P. The rest was financed by a $550 million senior secured credit facility and $250 million senior notes. I don’t think it would be a stretch to call this acquisition a disaster, however current management has taken steps to improve the situation.

In august 2023 SUP announced that Superior Industries Production Germany GmbH had entered Protective Shield Proceedings (German equivalent of chapter 11). These proceedings were limited only to the Werdohl, Germany production facility, effectively closing the facility and moving production to Poland. Alongside the closure of the Werdohl facility, they also consolidated aftermarket warehouses. The European restructuring as a whole should improve European margins by about 400 bps.

Financial analysis

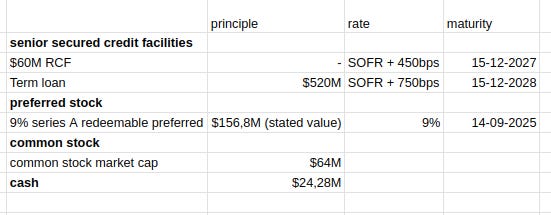

After a refinancing in august of this year the capital structure looks like this:

The RCF remains undrawn. The term loan was upsized to $520M and the maturity extended to 2028. These funds as well as a portion of the cash on the balance sheet were used to redeem the 2025 senior notes. The preferred shares were left untouched, however the spring provision from the term loan was removed. This means that TPG (holders of the prefs) have no recourse should SUP choose to not redeem the prefs in 2025. This allows SUP to keep the prefs as cheap financing because even though the prefs have a 9% rate on the stated value, the redemption value is twice the stated value. To redeem the prefs at par SUP would have to pay $313.6M, which means they are effectively paying a 4.5% rate. SUP has also recently started PIK’ing the interest and has removed the prefs from their debt maturity schedule. To me this indicates they want to force TPG to agree to a discount. Any discount would be immediately accretive to equity. The term loan has a mandatory repayment where 75% of excess cashflow and any unrestricted cash above $80 million has to be used to pay down the term loan. I would also mention that SUP owns their production facilities worth $145M that they could do a sales leaseback transaction on.

I think one of the reasons that the stock hasn’t worked yet is that the market is skeptical that SUP will execute on their plans. Pre refinancing and European consolidation I can understand that concern to an extent, however after the refinancing it makes no sense to me that the stock is down ~33%. The refinancing takes bankruptcy risk of the table and leaves a path towards deleveraging. Margins expanded in Q3 despite lower volumes showcasing the cost savings from the EU transformation.

Two important metrics for SUP are value-added-sales (VAS) and content per wheel. VAS is net-sales less aluminum cost. This is a useful metric since aluminum costs are passed through to customers and the price of aluminum is volatile resulting in volatile revenue figures. Content per wheel is VAS on a per unit basis.

I conservatively estimate FY2025 EBITDA of $164m based on 14 million wheels shipped, content per wheel of $51 (so VAS of $714m) and 23% margin. Assuming $35m capex and $60m interest expense leaves $69m for debt reduction in FY2025. Reason I believe this is conservative is that it assumes flat unit volume despite new platform wins in 2024 that start production in 2025, more or less flat content per wheel despite SUP growing this metric in the past few years and flat margins even though the cost savings from the European restructuring should expand margins. But even under these very conservative assumptions SUP is trading at 1x 2025 LFCF.

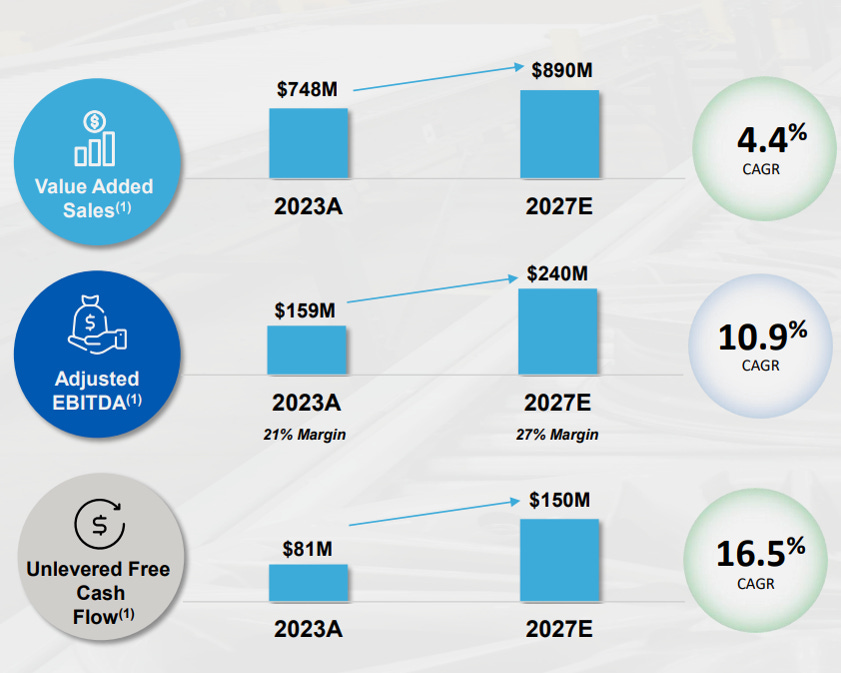

These are their 2027 targets:

I think these targets are very attainable when industry production normalizes to pre-pandemic levels. Consider that they sold 19 million wheels in 2019 versus roughly 14 million this year. If SUP can sell 18 million wheels in 2027 with content per wheel of $52, so VAS of $936M, at a margin of 26% you get EBITDA of $243M.

Management and major shareholders

As mentioned TPG are the holders of the preferred shares. They have a representative on the board. Mill Road Capital owns ~15% of the common stock and also have a representative on the board after reaching a standstill agreement with SUP. CEO Majdi B. Abulaban owns roughly 6% of the common stock. Mr Abulaban was appointed CEO in April 2019 and has done a brilliant job in my opinion. He took over a business with a bad balance sheet and struggling European segment and has managed this fairly well through a challenging few years. In this period he has reduced net debt from $626M to $497M, taken steps to address European under performance while growing KPI’s like content per wheel and EBITDA per wheel.

Industry backdrop

As I mentioned SUP is largely dependent on production volumes at OEM’s, particularly production in North America and Europe. Volumes peaked around 2017 and haven’t recover yet. The past few years have seen headwind after headwind for the auto industry. Lower sales during covid, chip shortage, supply chain issues and the UAW strike last year. These issues are now firmly in the past.

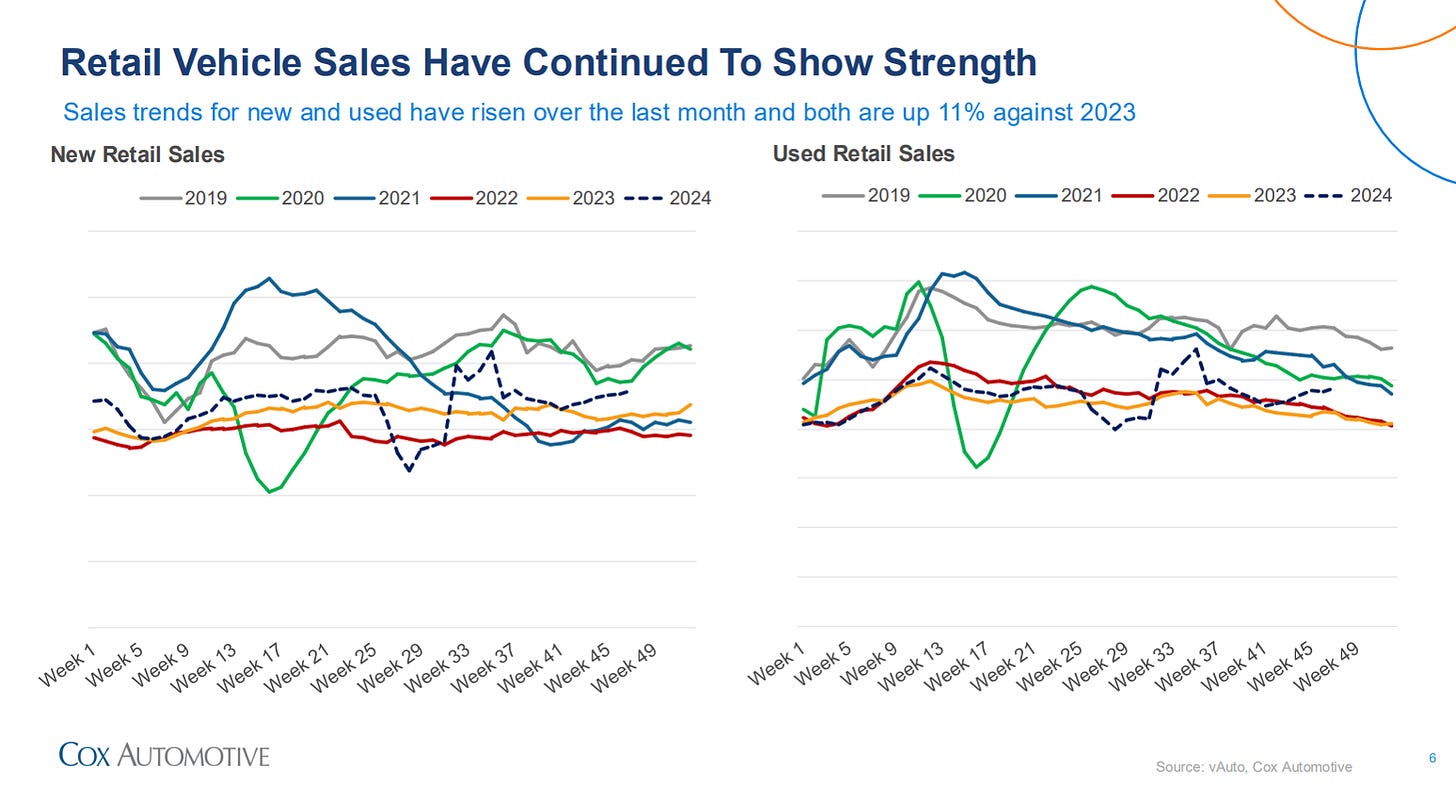

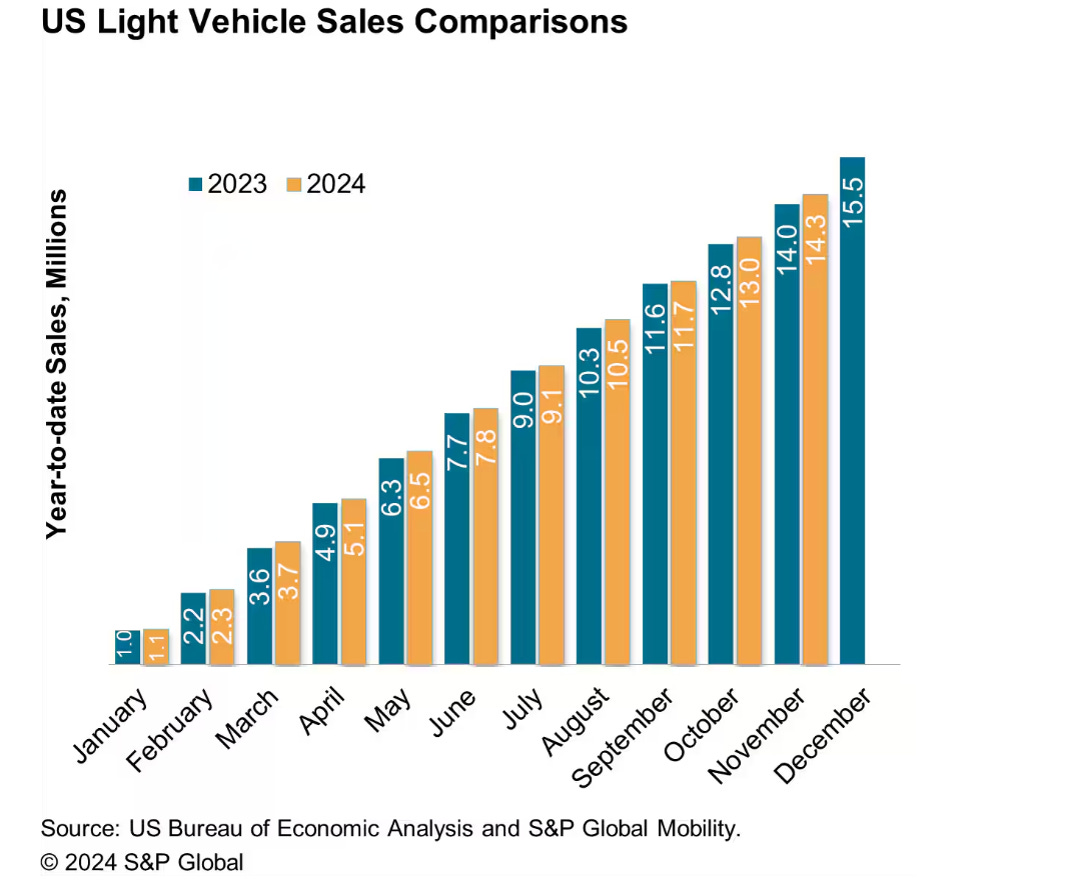

Even though US retail sales haven’t recovered to 2019 levels yet, sales are growing yoy.

Sales in Canada are recovering as well.

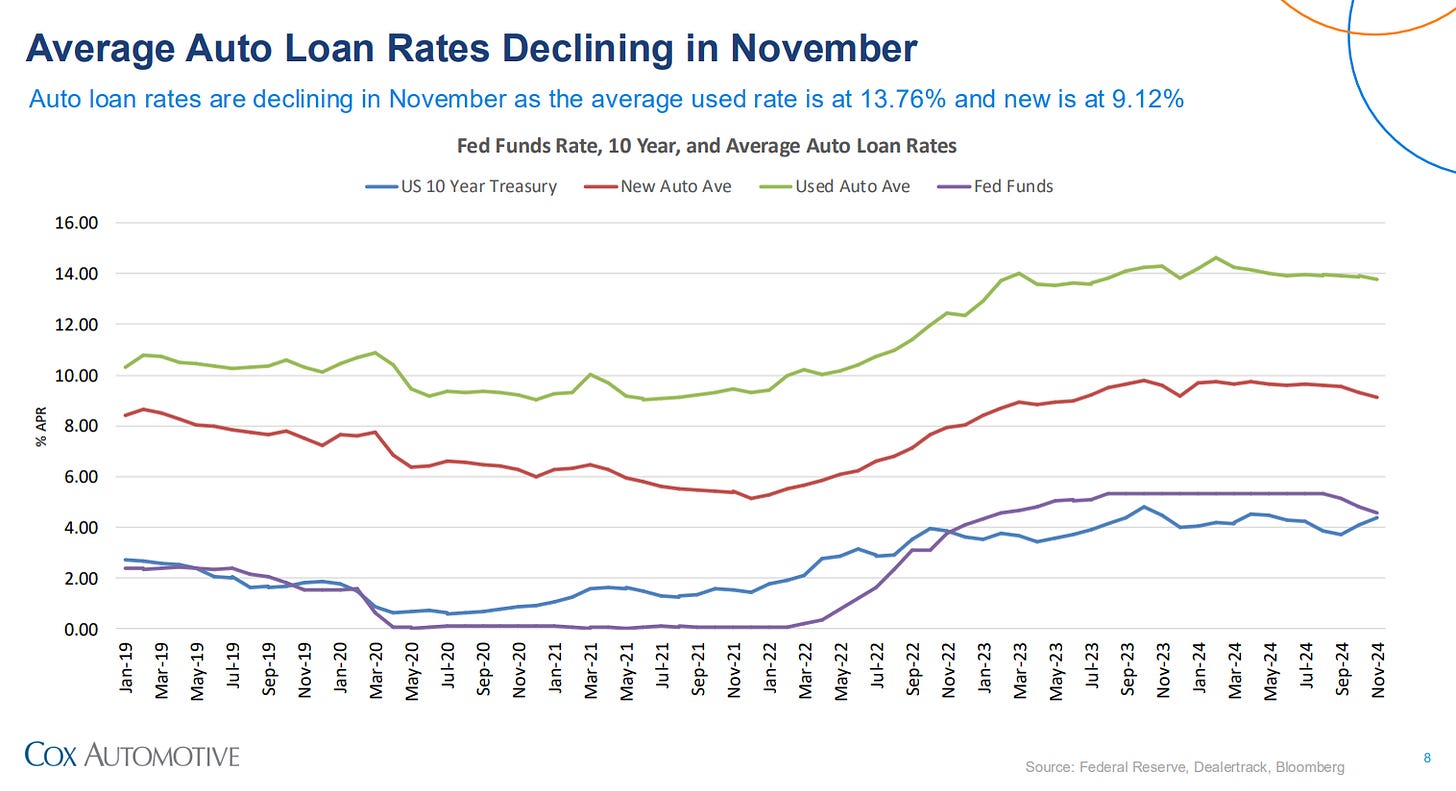

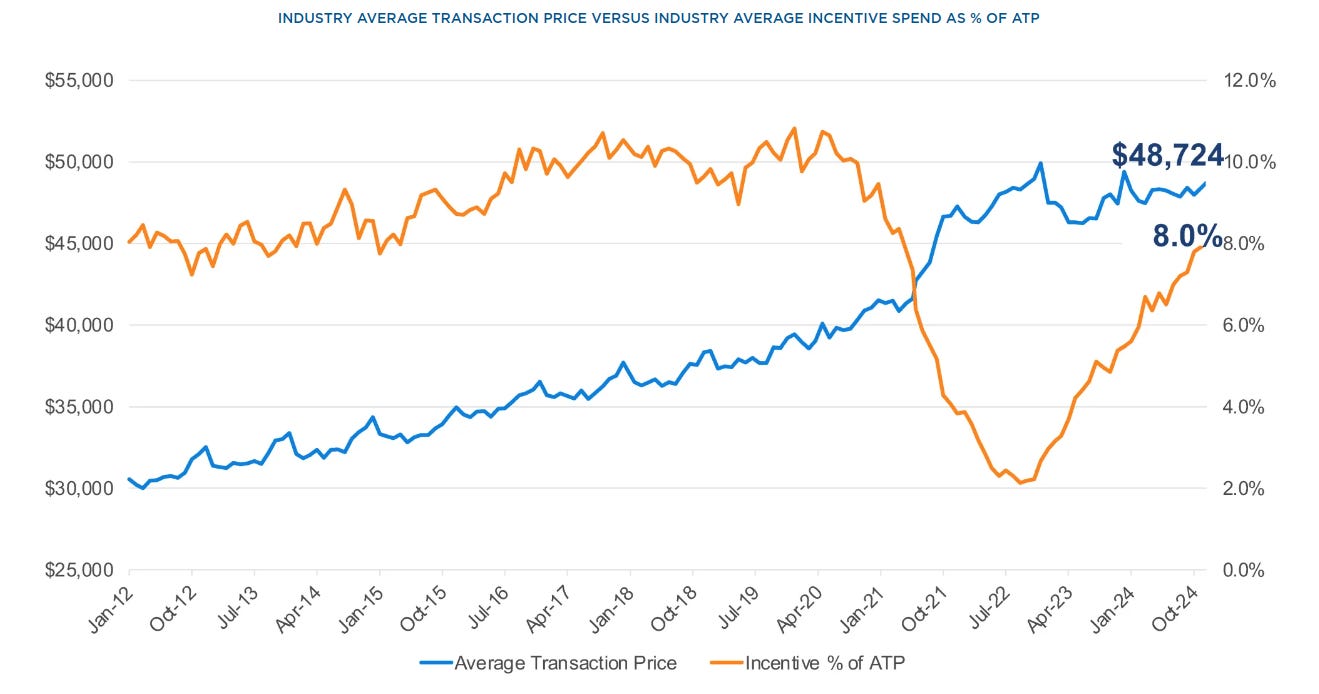

I expect this growing sales trend to continue for two reasons. Number one, the average age of vehicles on the road in the US is at a record 12.6 years. This combined with lower sales the past few years makes me believe there is significant pent up demand. The main issue holding sales back is affordability and this has recently started to improve. Average ticket prices are increasing at a slower rate and interest rates on auto loans are starting to come down while incentives are going up. To me this indicates a marked shift in industry sentiment where OEM’s are starting to push for volume again as opposed to increasing price.

.

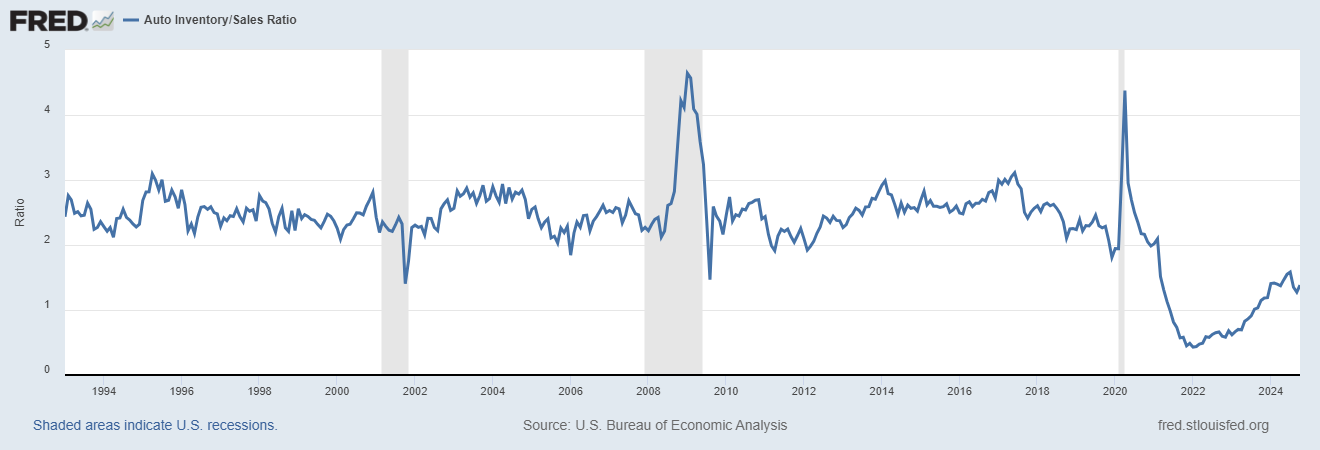

Inventory is still below the historic average.

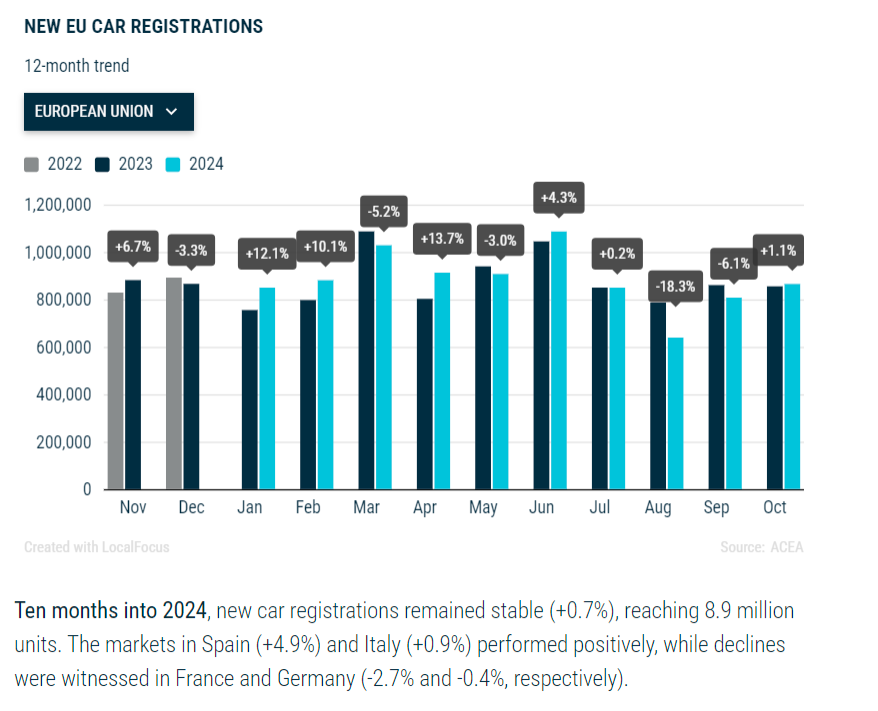

Europe is not recovering as quickly, however sales are still holding up well.

Even though production volumes in Europe are still down yoy, they have started to recover in recent months in countries like Germany and Spain. Year to date volumes are still down yoy, but are not falling of a cliff in Europe as a whole. Countries like the UK and Poland are seeing large declines, but these countries produce fewer cars than Germany and Spain.

It will probably take a while before European volumes recover to previous cycle highs, but I do believe the current negative sentiment around the sector is overdone. It is difficult to find a positive article about VW Group or Stellantis these days, however how much profit these businesses make is largely irrelevant to SUP. What matters is production volumes and they have been holding up alright.

Conclusion

Superior Industries has radically improved their business by moving production to a lower cost region and extending debt maturities to 2028. Even at current unit volumes SUP can rapidly pay down debt and is trading at only 1x 2025 LFCF. Improving vehicle affordability in my view signals an environment where OEM’s will increase production again, implying the cycle is turning. I believe this will start to be reflected in Q4 2024 results and FY2025 guidance. At this point the market should wake up to SUP’s low valuation and improving prospects.

Additional resources

Some twitter accounts with excellent coverage of SUP:

disc: long

my twitter: @rauwkost1

Thanks for the shout out mate