Quick Note: Sasol’s fiscal year ends in June, so FY2025 ends on June 30, 2025. They report financials every six months.

Sasol Ltd. (JSE:SOL, NYSE:SSL) is a South-African chemicals and energy company with global operations. The energy segment comprises a coal mining operation and natural gas production in Mozambique. This coal and gas are predominantly used as feedstock for Sasol’s refining and chemical operations. The energy segment makes products such as petrol, jet fuel, lubricants, etc. The majority of the liquid fuels are sold within South Africa through Sasol’s network of roughly 400 gas stations.

While the energy segment is a strictly African affair, the chemicals segment has a global presence with operations in Africa, the Americas, Europe, and Asia. The chemical segment produces a wide variety of chemicals for various end-markets, including automotive, agriculture, cleaning products, metal working, and lubricants.

The main South African production sites are Secunda, Sasolburg, and Netref. Natref is a refinery operated by a joint venture in which Sasol owns a 63.64% stake. Sasol has another joint venture, ORYX GTL, a synthetic fuel plant in Qatar in which it owns a 49% equity interest. The American operation primarily consists of the Lake Charles Chemical Project in Louisiana, with additional smaller operations in Texas and Arizona. Sites in Eurasia are located in Germany, Slovakia, Italy, and China.

A rough few years

In the years following the pandemic, Sasol benefited from high Brent oil and chemical prices as well as historically high refining margins. Naturally, the cycle turned, and the years following 2022 were challenging for many energy and chemical businesses. Destocking and added capacity resulted in lower prices, with lower earnings as a consequence. The chemical industry in particular is going through one of the deepest cyclical troughs in a long time.

While these factors are large drivers of Sasol’s earnings, they are by no means the only source of Sasol’s struggles. In October 2014, Sasol commissioned the Lake Charles Chemical Project (LCCP). Originally anticipated to cost US$8.1 billion, the project was intended to expand the company’s presence in the United States while benefiting from low-cost ethane. It wasn’t to be. Delays and cost overruns resulted in the plant being completed two years after its intended date, and the final cost ended up being US$12.8 billion. It culminated in 2020 with the sale of a 50% stake in the base chemical unit at Lake Charles to LyondellBasell for US$2 billion. In 2024, the company took a R45.5 billion (~US$2.5 billion) impairment charge related to the American Chemicals segment. This is a significant amount of trouble for a segment that contributes very little to the bottom line, as shown below.

Finally, there have been some problems with the African value chain. The coal mined to supply the Secunda operation has deteriorated in quality, forcing Sasol to buy coal from external sources. Civil unrest also disrupted the natural gas supply from Mozambique, however, operations have since been resumed.

This too shall pass

While it is impossible to predict when the energy and chemical cycle will improve, global refining margins have started to improve in recent months. It remains to be seen if this trend can persist, but at least it indicates that things have stopped getting worse. While the chemical market has not recovered yet, I do believe the largest cyclical decline is behind us. Demand is growing slowly, and capacity in some places is being taken offline, while it is being added in other places (particularly China). It will probably take a year or two for a full recovery; however, by then I expect Sasol’s stock price to have appreciated significantly.

More pressingly, the overseas operations are being addressed. As mentioned, they barely contribute to the bottom line while being the crux of the company’s problems. The company is looking at which assets need fixing and which need to be shut down. As part of this, Sasol exited the US Phenolics business in March, with decommissioning of activities in Texas to follow later this year. These restructuring efforts are starting to show results.

Eventually, this will lead to the US Chemical business being spun off, as mentioned by the CEO in an interview with Bloomberg earlier this year: “In the future, at the peak of the chemical market, it’s going to give us lots and lots of strategic options to create shareholder value, where you can have an option to either list it by itself or you can merge it with someone else“. Importantly, he also mentioned that they won’t be interested in a fire sale that would be value-destructive. I think the easiest and most logical step would be to sell to LyondellBasell, considering they already have a 50% interest in the LCCP.

To address the feedstock problems in the African value chain, Sasol has commissioned a destoning project aimed at improving the quality of the coal they mine. This is expected to be operational in the first half of FY2026.

Not a sign of distress

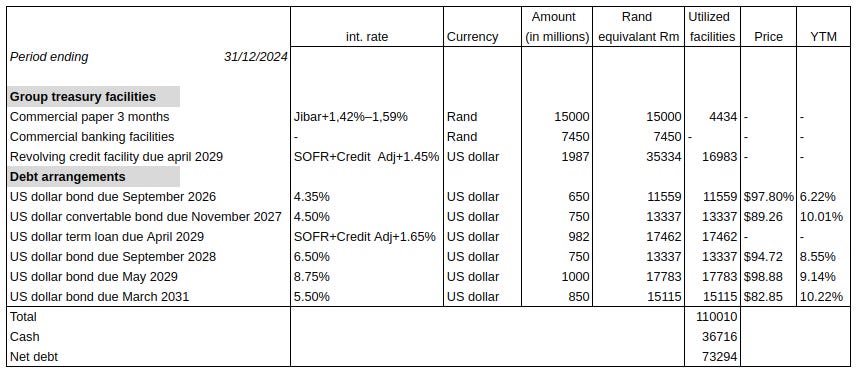

Some of the discourse surrounding Sasol (in news articles and wherever else people discuss stocks on the internet) focuses on the debt they carry on their balance sheet. Some even seem to suggest there is a possibility of bankruptcy. While any company could go bankrupt, even an elementary inspection of Sasol’s capital structure will tell you that the likelihood of that happening is quite low.

Debt markets aren't spooked at all, and with a TTM adjusted EBITDA of roughly R56 billion, net debt/EBITDA stands at only 1.3x. This even excludes a R4.2 billion payment from Transnet from a legal settlement that Sasol will receive before 30 June 2025.

Conclusion and valuation

The company is finally addressing issues that need fixing, and after a turbulent few years, it is focusing on eventually getting back to its South African roots. Given the many factors influencing Sasol’s earnings, I think it would be nearly impossible to forecast precise earnings figures. However, for reasons I have pointed out, I believe that earnings are close to bottoming. Even on current earnings, Sasol is a bargain. In 1H2025, Sasol reported EPS of R7.22 and HEPS of R14.13 (HEPS stands for Headline earnings per share, which strips out certain items, make of that what you will…). Annualise this and you get EPS of R14 and HEPS of R28. With a current stock price of R82.80, this puts the PE at either 5.5 or 3, depending on how cynical you are regarding HEPS. For what I believe to be trough earnings, that is not a bad multiple. From an asset perspective, Sasol is trading for a fraction of its replacement value, with an enterprise value of roughly R127 billion (~US$7.2 billion). Just the struggling US assets will likely be worth more than that at the next cyclical peak.

Disclosure: I am long Sasol

I agree on the earnings and potential, but probably there is some hidden debt in the form of forced capex to Greenify the company because it's a huge pollution source in SA