The Riga exchange is home to one of the more unique businesses I have come across recently. Siguldas (SCM1R) sells bull semen from their sire catalogue. They also offer insemination services. Unfortunately, a €2 million market cap and almost non-existent turnover make it uninvestible. Luckily, there is more than one business listed in Riga.

Eleving Group

Eleving Group (ELEVR) is a fintech primarily focusing on vehicle and consumer financing. Founded in 2012, it IPO’d in 2024 and operates in 16 countries across Europe, Africa, and Central Asia. They have a (short) history of steadily growing earnings and tangible book value.

80% of Eleving’s funding comes from bond and note issuance. The majority of these are Eurobonds; however, the company also issues notes in local currency. The nearest bond maturity is next year, when a €150 million bond matures. The company is actively engaged in talks for its refinancing.

Net NPL ratio has remained stable over the past few years. For their vehicle financing portfolio this ratio is just north of 6%. For consumer financing, this is just shy of 5%.

Eleving intends to grow by expanding into new markets in Europe and Africa, as well as launching new products. As an example, they recently launched smartphone financing in Uganda.

With its current market cap of €195 million, it is trading at roughly 8 times earnings and a 7.6% dividend yield. A tangible book value per share of €0.72 means a P/TBV of 2.3

Virši

Virši (VIRSI) operates 82 service stations mainly in Latvia. The sale of fuels contributed 47.7% to gross profit, while convenience store sales contributed 49.8%. The remainder comes from the energy segment, which sells electricity.

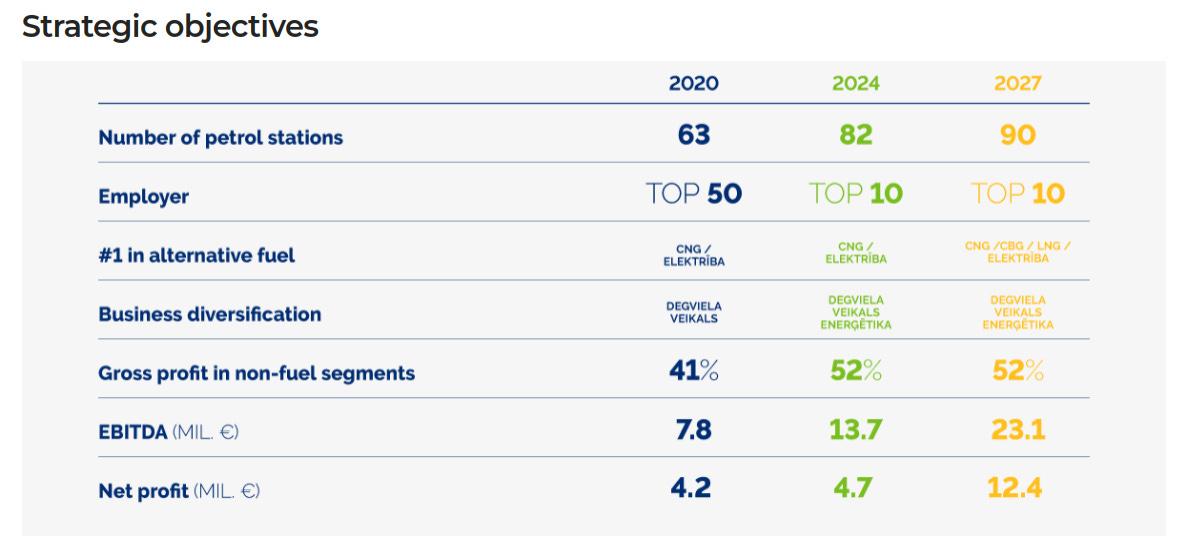

The past few years Virši has focused on growth. They have grown the number of their service stations from 63 in 2020 to 82 in 2024. Investment in this growth, as well as modernising existing service stations, has depressed earnings in recent years. These are the company’s targets for 2027, which I think are very achievable.

These newly opened service stations have partly been financed by issuing debt. Total debt has gone from €18.6 million in 2020 to €35.3 million in 2024. With EBITDA of €13.7 million in 2024, net debt/EBITDA stands at only 2.3x. I wouldn’t consider this an issue.

At a market cap of €60 million, it is trading at 12.8 times last year’s earnings. It also implies a PE of 5, should Virši reach their 2027 targets.

Currently, Latvia has the lowest number of cars per capita in the EU. Should this increase in the future, it would be a nice tailwind for Virši.

DelfinGroup

DelfinGroup (DGR1R) likes to call itself a fintech, even though it is mostly a pawnshop operator. They do this through their Banknote and Vizia brands. They have over 90 locations in Latvia and Lithuania. Through these branches, they buy and sell items that people bring in to pawn. They issue pawn loans as well as regular consumer loans. The items in store can also be purchased online via Banknote. The online stores for both Latvia and Lithuania were recently consolidated, allowing people from either country to purchase items from the other.

The Vizia brand issues online consumer loans ranging from €100 to €10.000. Consumer lending makes up 74% of revenue, pawn loans 14%, and retail 12%. To grow retail sales, the company is promoting the circular economy to get people to buy second-hand items.

The consumer loan portfolio grew in Q1 to €111.3 million. This growth has come from higher loan issuance as well as the average loan amount going up. The average term of loans has increased as well to 3.4 years. Just a few years ago, this was less than 3 years. The NPL ratio has crept up to 3.8%. The company claims this is due to fewer NPL sales to collection companies. It is still well within Delfin’s internal target of 7%.

Pawn loan issuance has increased as well. Similar to consumer loans, the average pawn loan amount has increased to €122. These loans have an average term of around two months.

Most of Delfin’s funding comes from issuing bonds. These bonds have an 11% and 13% interest rate. The company is in compliance with all covenants.

The businesses’ strategy seems to be working reasonably well, considering it is growing revenue at a high double-digit rate and earnings at a low double-digit rate. It has grown book value at a double-digit rate as well. The company pays a quarterly dividend and has a yield of 7%. At a market cap of €54 million and TTM net income of €7.5 million, Delfin has a PE of 7.2. P/TBV stands at 2.3x.

Disclosure: I have no position in any of the securities mentioned.