Elevator Pitch #2: Some Questionable Oil Companies

Distressed oil producers: what's not to like?

Preface: I am a generalist, and oil and gas companies require specialist expertise; so be aware that you are reading the ramblings of a tourist.

Tullow Oil Plc (TLW UK) is an oil and gas producer in Africa. It has producing assets in Ghana and Côte d’Ivoire. This production comes from three different fields. A quick overview of their production fields with working interest between brackets:

Jubilee in Ghana (38.98%): 2P reserves of 102.6 MMboe, of which oil 79.6 MMboe and gas 138.4 Bcf (23 MMboe). Oil production 33.9 kboepd.

TEN cluster in Ghana (54.84%): 2P reserves 25.2 MMboe, all of which is oil. Oil production 10.2 kboepd.

Espoir in Côte d’Ivoire (21.33%): 2P reserves 0.6 MMboe, of which oil 0.5 MMboe and gas 1.1 Bcf (0.1 MMboe). Oil production 1.0 kboepd.

Total natural gas production in 2024 was 6.6 kboepd.

As of December 31, 2024, these fields have 2P reserves of 128.4 MMboe. With 2024 production of 21.8 MMboe, these fields have a reserve life just shy of six years. Tullow does have 2C contingent resources of 711 MMboe.

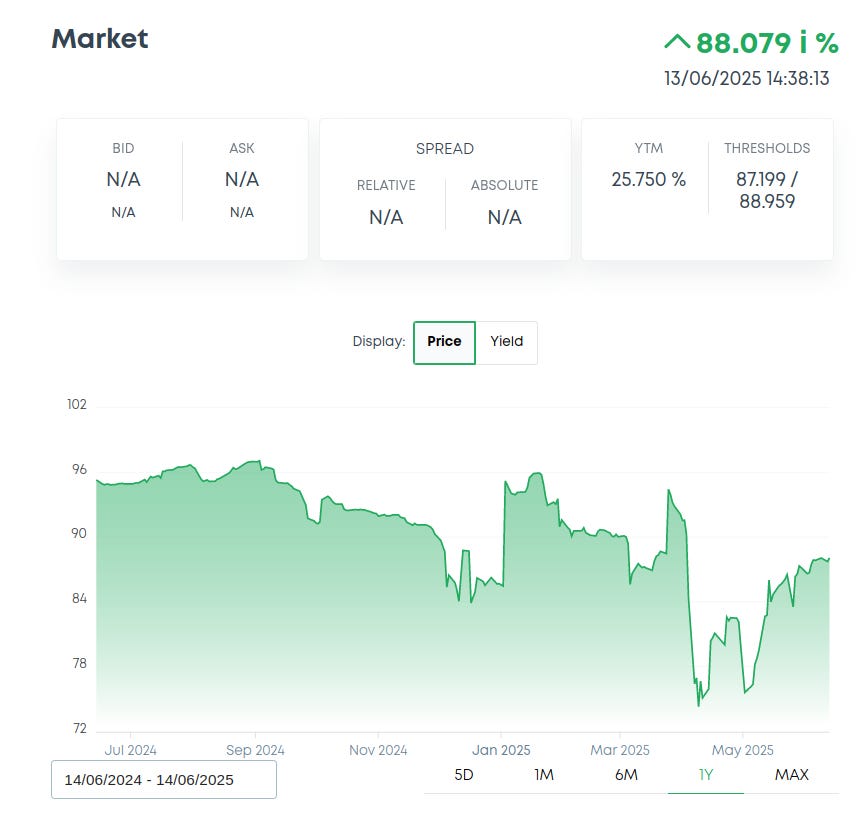

Tullow Oil previously had producing assets in Gabon, but these were recently sold for US$300 million to reduce its debt. The company’s goal is to reduce net debt to US$1.1 billion by the end of the year. The largest and most urgent piece of this debt is the senior notes due 2026. Currently, they have roughly US$1.3 billion of these notes outstanding and will need to refinance them. This is how they have traded recently:

Non-Executive director Roald Goethe doesn’t seem to think that refinancing these notes will be an issue, considering he has bought 1.4 million shares in the open market this year for a total consideration of 213.250 GBP. This takes his ownership to roughly 26 million shares, or 1.8% of the company.

I estimate Tullow to be cash flow break-even around $65 Brent.

Kosmos Energy Ltd.

Kosmos Energy Ltd. (KOS US) also has a working interest in the Jubilee and TEN fields in Ghana, along with assets in other geographies. A quick breakdown of their producing assets:

Mauritania and Senegal: Greater Tortue Ahmeyim Project (GTA), LNG project with Q1 2025 production of 1,300 boepd net (7.8 mmcfd).

Ghana: Jubilee and TEN (38.6% and 20.4% working interest). Q1 production 33 kboepd.

Gulf of Mexico: Various fields. Q1 production 17.2 kboepd.

Equatorial Guinea: Ceiba Field and Okume Complex (40.375% working interest). Q1 production 9.0 kboepd.

Kosmos has 2P reserves of 528 MMboe as of 31 December 2024. With an average production of 23.3 MMboe over the past few years, these reserves have a reserve life index of 22 years.

Kosmos had $2.85 billion of net debt at the end of Q1 2025. Their nearest maturity is $250 million bonds due April 2026, with liquidity of $400 million; this shouldn’t be an issue.

I estimate Kosmos to be cash flow break-even around $80 Brent.

Here are some quick valuation ratios:

Why not some more sensible names?

In short, I think these two names are the right amount of shitco. I think they’ll provide sufficient torque in the event of a sustained bull market in oil, without requiring $150 Brent to work. Tullow Oil also has a catalyst with a possible refinancing of its 2026 notes, which I think they’ll be able to do successfully. Charts for both names also seemed to have bottomed. For a higher-quality company, I would be looking at BW Energy (BWE.OL).

At the time of writing (Sunday, 15/06/2025), I don’t own these names yet, because they have gone up a lot in recent days due to geopolitical events. While I am not remotely close to being an oil trader, I don’t think it is a good idea to add energy exposure during a geopolitical spike. Contrary to popular belief, most of the time, the world doesn’t end. So I expect this spike to be relatively short-lived, and I would be looking to gradually build a small position after a possible pullback.

Disclosure: No position (yet)